Automated Hedging System

Protecting Liquidity Providers

Siren Flow’s vaults incorporate an automated hedging system that protects liquidity providers from delta exposure by interacting with Arbitrum-based perpetual protocols like Perennial. This advanced feature ensures that LPs’ returns remain uncorrelated with market movements. By integrating automatic delta-hedging of pool exposure with perpetual and DEX protocols, Siren Flow provides LPs with yield opportunities that are insulated from the volatility of crypto markets.

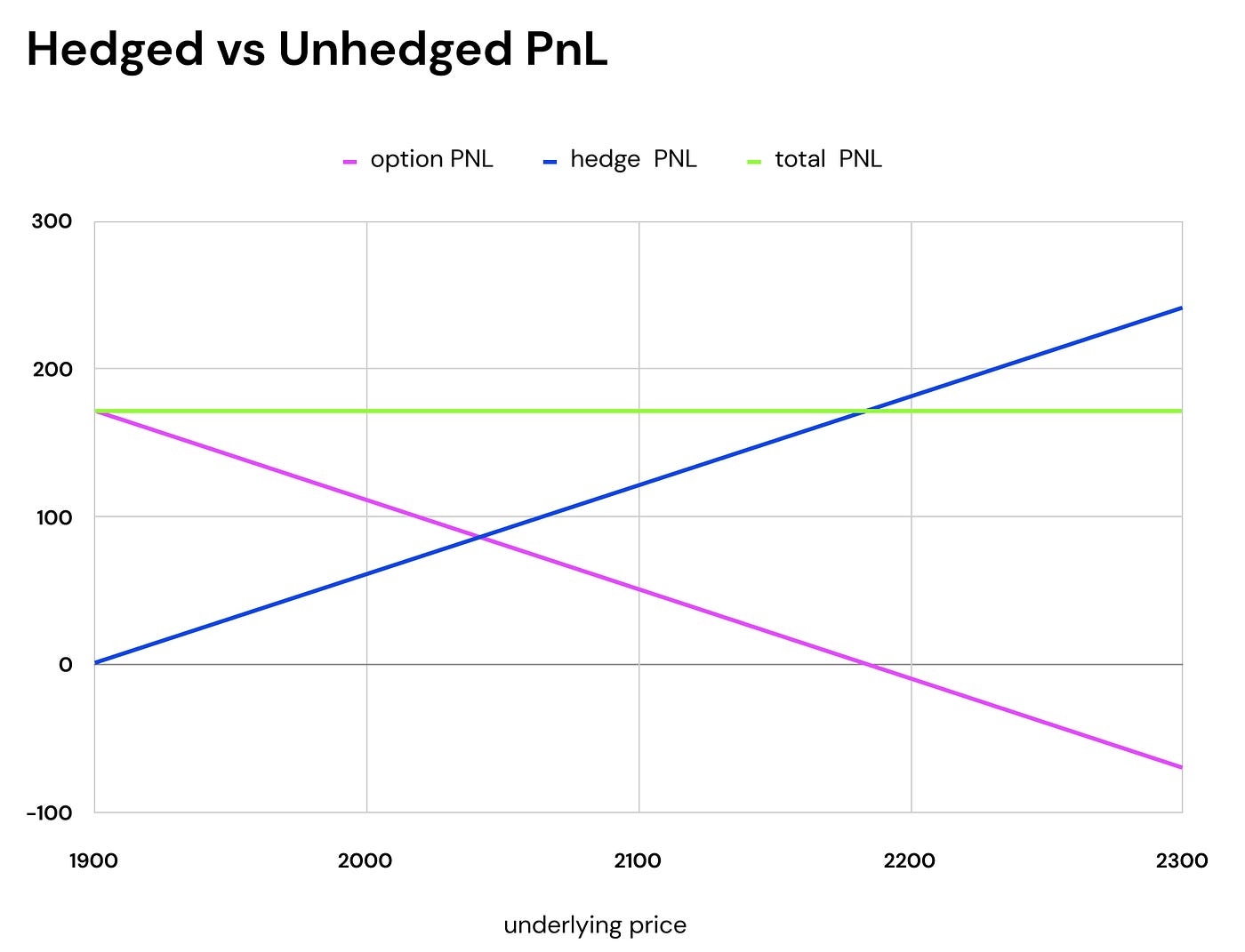

Above is a comparison of hedged vs unhedged profit-loss (PnL) of a short call option position with strike price of 2,000. The writer initially receives $175 from selling the options to the trader. As the price of the underlying asset rises, the option increases in value, resulting in projected losses for the writer (pink line).

To hedge their delta exposure, the seller can purchase a perpetual contract and update it frequently to match option delta Δ (blue line). In this example, the hedge is updated every $10 move in price. As the option increases in value, creating losses for the writer, the corresponding perpetual position profits proportionally. The green line represents combined PnL — as we can see, it enables the seller to decouple their return from the market price movements and protect their initial premium received.

These hedged positions are created and maintained by the Hedge Keeper, an off-chain module that can connect to many different perpetual protocols and DEXs. Similarly to how having the Quote Provider off chain allows pricing to be responsive, moving the Hedge Keeper off chain allows it to calculate the hedge proactively, in advance of the latest asset price being known on chain. This advantage has the potential to increase the accuracy of the hedge, improving LP yields.

Liquidity providers on Siren Flow do not seek directional exposure to the underlying price; instead, they earn yield from facilitating markets for traders through automated delta hedging.

NOTE: This is a living document that will continue to be updated as Siren evolves. To contribute, please visit Siren on GitHub. Specific questions may be answered and technical guidance may also be provided from time to time in the Siren Discord to those who are interested in building on top of the protocol.

Last updated