Unified Liquidity Pools

Supporting Options for Any Asset

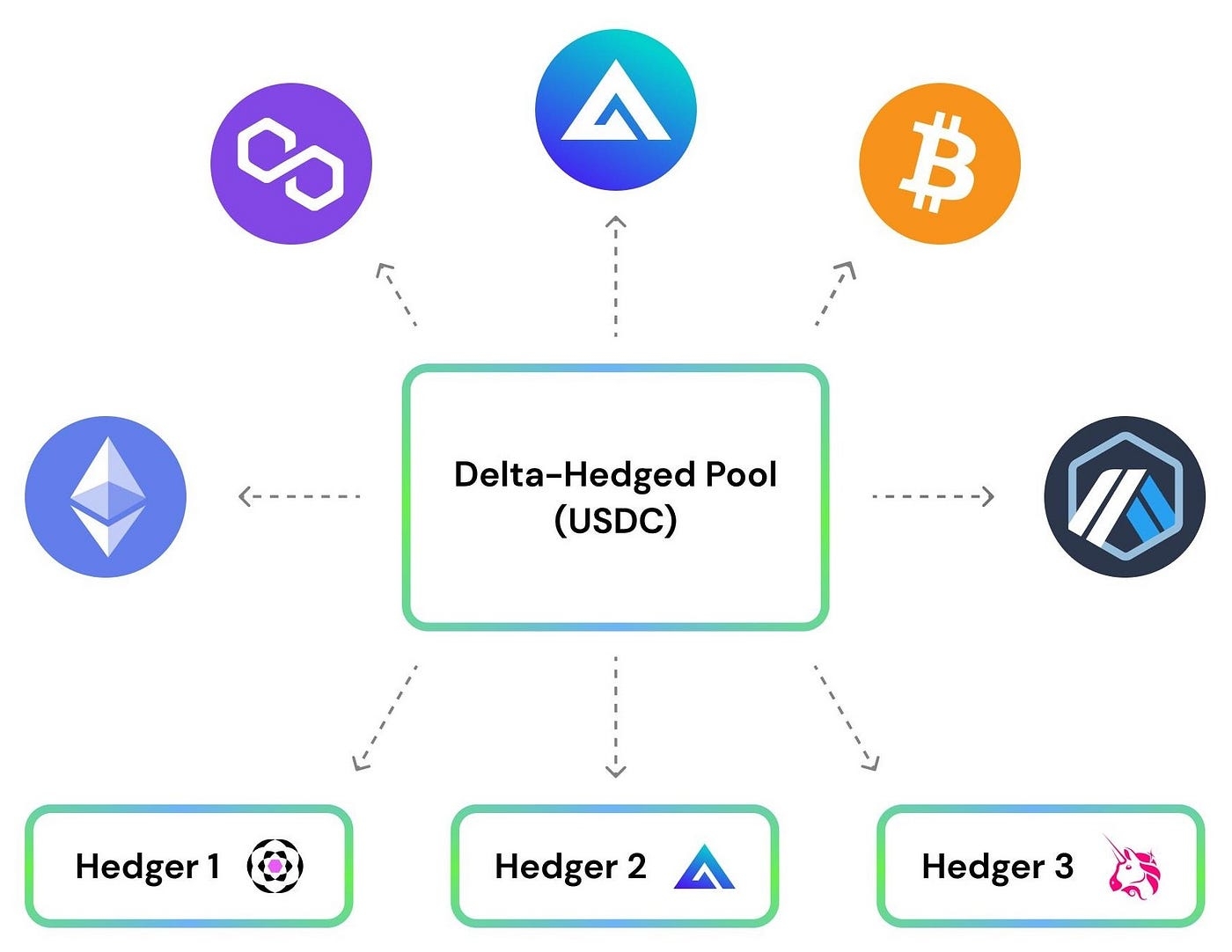

Siren Flow’s model of using stablecoins as collateral for all options allows the platform to create options for a wide range of assets, regardless of whether token-specific liquidity pools already exist for those assets.

Unified Liquidity Pools enable traders to purchase options for any asset with a reliable price feed, greatly expanding the range of available options. By adopting this model, Siren Flow offers unparalleled flexibility and opportunities for traders in the DeFi options space.

Under the new system, LPs no longer need to maintain different assets in multiple pools in order to earn yield. By consolidating liquidity into a single pool that earns aggregated fees across various markets, Siren Flow simplifies and enhances the user experience.

NOTE: This is a living document that will continue to be updated as Siren evolves. To contribute, please visit Siren on GitHub. Specific questions may be answered and technical guidance may also be provided from time to time in the Siren Discord to those who are interested in building on top of the protocol.

Last updated