Portfolio Margin

Enhancing Capital Efficiency and Flexibility

Siren Flow introduces a sophisticated margin management system, allowing traders to safely buy partially-collateralized options and execute complex positions. This system enhances the capital efficiency of the liquidity pools, allowing even more trades to be made, and brings the DeFi experience closer to that of centralized platforms. With the new margin system, traders can use even more advanced trading strategies, including vertical spreads, butterflies, calendar spreads, and straddles, while still experiencing the benefits of DeFi self custody.

The key advantage of spreads is that they allow maximum loss to be capped, requiring less collateral than underwriting a naked option. Because the pool handles trading across multiple series of options, it is likely that at any given moment it contains options positions that offset each other. Thus, a portfolio margin system that automatically detects offsetting positions allows less collateral to be locked, providing higher capital efficiency and deeper liquidity for traders.

For example, let’s consider a portfolio consisting of two options expiring in a month (underlying price is $1,800):

Short ETH 1500 Put ($34 premium)

Long ETH 1700 Put ($98 premium)

If margin for each position is evaluated separately, then an absolute minimum margin required for the short option is its current premium, $34. However, in reality the required margin should be higher to account for an adverse market scenario.

A conservative short option margin can be calculated by shocking spot price and implied volatility. If we assume 50% spot shock ($900 underlying price) and 200% IV then the premium of the short option becomes $669 — which is the amount of margin required for this naked short position. The long option requires no margin, so the total margin required is $669

Now let’s look at portfolio margin system that takes into account the fact that the two positions offset each others risk:

In case of the underlying price decline, the long 1700 put will become in-the-money before the 1500 short put. The losses of the short put will be more than offset by the profits of the long put.

Let’s confirm this by calculating the net PnL of the portfolio under the same shock scenario (50% price decline, 200% IV). The 1700 put premium is $849. The 1500 put premium is $669. Net premium is $849 — $669 = $180. Note the positive value means a profit for the portfolio, which means it actually benefits from the downside price movement, and doesn’t require any margin.

In case of an upside price movement both options expire out-of-the-money, which requires no margin as well.

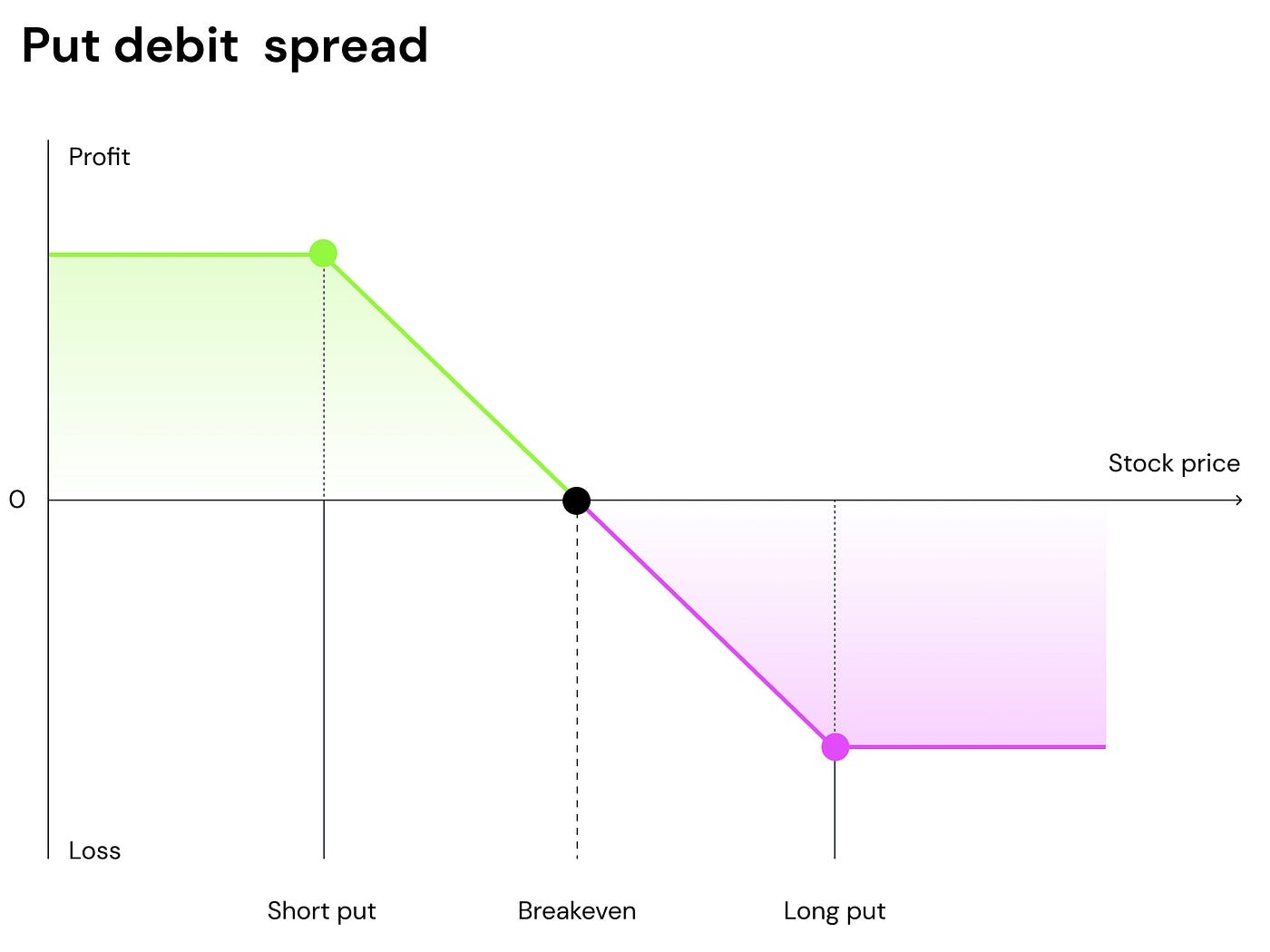

Therefore, the net margin requirement for this portfolio of two options when calculated via the portfolio margin system is zero. This amount can be easily calculated without any scenario analysis by simply observing that the long put strike is higher than the short put strike–a so-called “debit put spread” — which requires no margin (see the PnL chart below).

Using the portfolio margin system reduces the margin requirements from $669 to $0. The pool doesn’t need any collateral to hold this position, which unlocks the collateral to be used for other trades, greatly increasing the market liquidity.

NOTE: This is a living document that will continue to be updated as Siren evolves. To contribute, please visit Siren on GitHub. Specific questions may be answered and technical guidance may also be provided from time to time in the Siren Discord to those who are interested in building on top of the protocol.

Last updated