Capital Management

Deposits and Withdrawals in Rounds

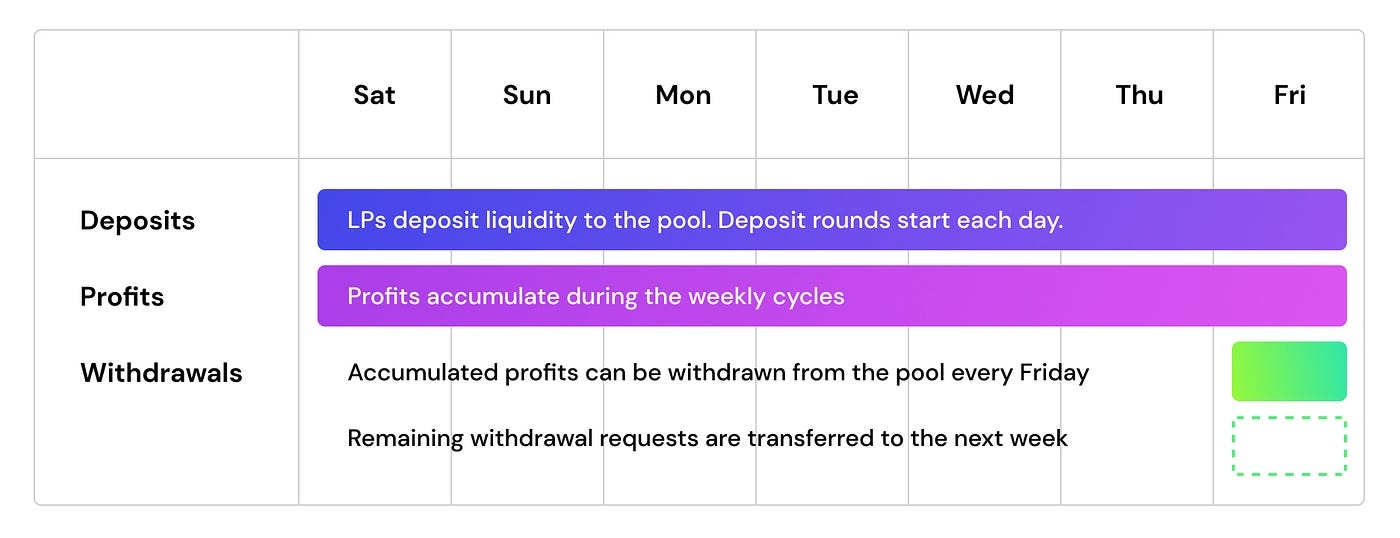

Siren Flow implements a round-based structure for deposits and withdrawals, which improves the protocol’s capital efficiency as well as allowing LPs greater flexibility in managing their funds. With daily deposit rounds and weekly withdrawal rounds, Siren Flow streamlines the process of contributing and withdrawing liquidity, while ensuring that funds continue to earn yield during the withdrawal process.

Weekly withdrawal rounds enable the protocol to decouple the time it takes for an LP to withdraw funds from the duration of options in the pool portfolio. Any incoming cash flow into the pool first gets allocated towards outstanding withdrawal requests and only the remainder is released into the pool liquidity. Cash inflows occur in the following instances:

Option collateral released from a short position when a matching long position is sold back to the pool

Option settlement post expiration

New deposits

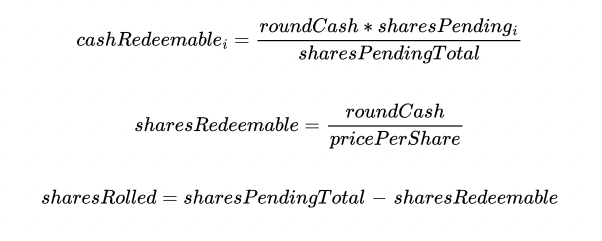

All cash flows accumulated during a withdrawal round are distributed pro-rata to satisfy outstanding withdrawal requests. If a portion of the total shares pending withdrawal cannot be satisfied in the current round, they are automatically rolled into the next round.

NOTE: This is a living document that will continue to be updated as Siren evolves. To contribute, please visit Siren on GitHub. Specific questions may be answered and technical guidance may also be provided from time to time in the Siren Discord to those who are interested in building on top of the protocol.

Last updated