Hybrid Pricing Model

Creating Competitive and Efficient Prices

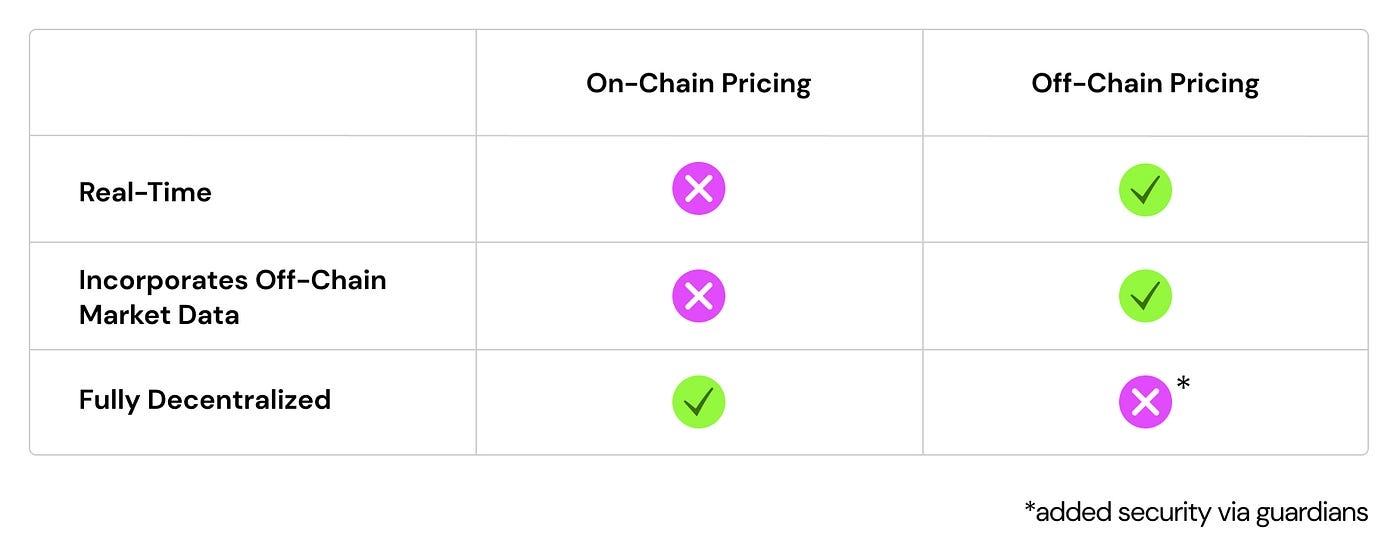

Siren Flow employs a unique hybrid on-chain/off-chain RFQ system to deliver competitive pricing for options trades. This innovation allows Siren Flow to offer pricing comparable to centralized exchange derivatives while retaining the benefits of self-custody and decentralized trading. The hybrid pricing model combines on-chain execution with off-chain quote generation, paving the way for more sophisticated protocol elements. This ensures traders no longer have to choose between security and competitive pricing, as they can have both with Siren Flow.

In Siren Flow, prices are not calculated on-chain. Instead, price generation for trades is delegated to Quote Providers. Quote Providers are specialized off-chain services that maintain an internal volatility surface, which incorporates both on-chain and off-chain data to provide competitive real-time price quotes.

For the initial Siren Flow testnet and launch, the protocol will use Quote Providers created by the Siren Team. In the future, Siren Flow plans to connect to other pricing providers, such as Sommelier, to expand its access to data and generate even more competitive and accurate pricing. This feature will further enhance Siren Flow’s value proposition and increase the benefits for traders and LPs.

When users perform trades on Siren Flow, they ask the Quote Provider API to generate a cryptographically signed order containing one or more options trades (legs). The order specifies the premium paid or received for each leg of the order. Traders can execute the order by submitting a transaction on chain, which is instantly settled. After the settlement, options tokens are sent to the trader’s wallet.

Order structure:

To mitigate the risk of having the RFQ system off-chain, each order is co-signed by Guardians to prevent malicious orders from being settled against a pool.

NOTE: This is a living document that will continue to be updated as Siren evolves. To contribute, please visit Siren on GitHub. Specific questions may be answered and technical guidance may also be provided from time to time in the Siren Discord to those who are interested in building on top of the protocol.

Last updated